new orleans sales tax rate

Get the latest business news. The Louisiana LA state sales tax rate is currently 445.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

In fact many New York counties outside of New York City have rates exceeding 250 which is more than double the national average of 107.

. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7There are a total of 263 local tax jurisdictions across the state collecting an average local tax of 5076. Find the top French Quarter hotels here. Suffolk County has one of the highest median property taxes in the United States and is ranked 12th of the 3143 counties in order of median property taxes.

The average effective property tax rate in the Big Apple is just 088 more than half the statewide average rate of 169. With new orleans parking no need to drive around a parking garage looking for a space to park your car as we will come around to direct you right to an open place. Book a room at a BB to mingle with locals or a grand French Quarter Hotel to experience the luxury.

Parish E-File can pay City of New Orleans and State of Louisiana sales taxes together SalesTaxOnline. Orleans County OR 3481 00 00 8 Oswego County outside the following OS 3501 00 00 8 Oswego city OS 3561 00 00 8 Page 2 of 4 ST-101 222 A22 Annual Step 3 Calculate sales and use taxes see instructions Column C Column D Column E Column F Taxable sales Purchases subject Tax rate Sales and. Select the Louisiana city from the list of popular cities below to see its current sales tax rate.

Find international small and New Orleans Louisiana local business news articles about economy and finance along with up. The Times-Picayune and New Orleans Advocate joined forces in July of 2019 under local ownership and returned the Times-Picayune to seven-day home delivery. The French Quarter offers a variety of places to stay.

Sub Total 1500. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875There are a total of 640 local tax jurisdictions across the state collecting an average local tax of 4254. The median property tax in Suffolk County New York is 7192 per year for a home worth the median value of 424200.

Orleans County 4 Oswego city 4 Otsego County 4 Rensselaer County 4. See on Map. Pay Online 2000.

French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019 Present. The only thing more New Orleans than a dented pot of gumbo simmering on the back burner is arguing about the right way to make it. Combined with the state sales tax the highest sales tax rate in New York is 8875 in the cities.

The following information is designed to provide an introduction to the property tax assessment process including appeals to the Board of Review and the laws that govern them in Orleans Parish. How to Appeal to the Louisiana Tax Commission. Suffolk County collects on average 17 of a propertys assessed fair market value as property tax.

Appeal to Louisiana Tax Commission - LTC Form 3103A. Sales Tax 000 Amount Total 2000. Generally the New York State sales and use tax rate on motor fuel and highway diesel motor fuel is a cents-per-gallon rate.

Louisiana has recent rate changes Tue Oct 01 2019. With local taxes the total sales tax rate is between 4450 and 11450. Click here for a larger sales tax map or here for a sales tax table.

Seniors age 65 or older with income below 12000 can claim an income tax credit for the amount that their property tax exceeds 1 of total income up to 200. With a heritage claiming both French and West African roots gumbo is a thick stew served over rice and made with a roux a mixture of butter and flour and a wide variety of ingredients such as celery peppers okra onions chicken sausage andor. Service Fee 500.

Click here for a larger sales tax map or here for a sales tax table. The Times PicayuneNew Orleans Advocate is a Louisiana owned newspaper that has served the metro New Orleans area for more than 182 years. In New York City property tax rates are actually fairly low.

Combined with the state sales tax the highest sales tax rate in Louisiana is 1295 in the city. Depending on local municipalities the total tax rate can be as high as 1145. Due at Lot 000.

The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average. Louisiana was listed on Kiplingers 2011 10 tax-friendly states for retirees. Effective June 1 2022 and continuing through.

If you have questions about how property taxes can affect your overall financial plans a financial advisor in.

Louisiana Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

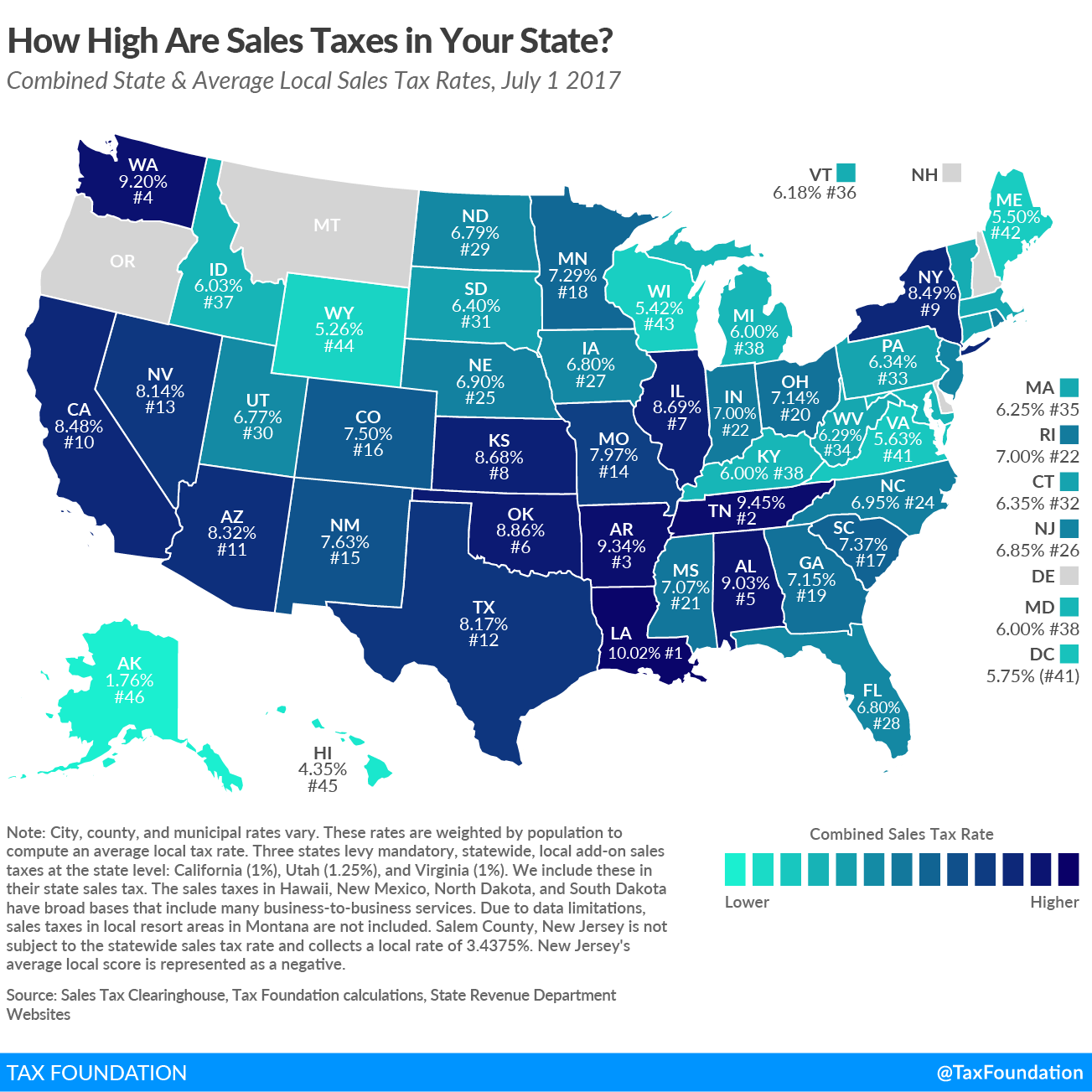

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Louisiana Sales Tax Rates By County

Sales Tax Holidays Politically Expedient But Poor Tax Policy

States With Highest And Lowest Sales Tax Rates

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

State Income Tax Rates Highest Lowest 2021 Changes

How To Calculate Sales Tax Video Lesson Transcript Study Com

New Orleans Louisiana S Sales Tax Rate Is 9 45

Sales Tax On Grocery Items Taxjar

Sales Taxes In The United States Wikiwand

Nevada Sales Tax Guide For Businesses

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Tips

Pennsylvania Sales Tax Guide For Businesses